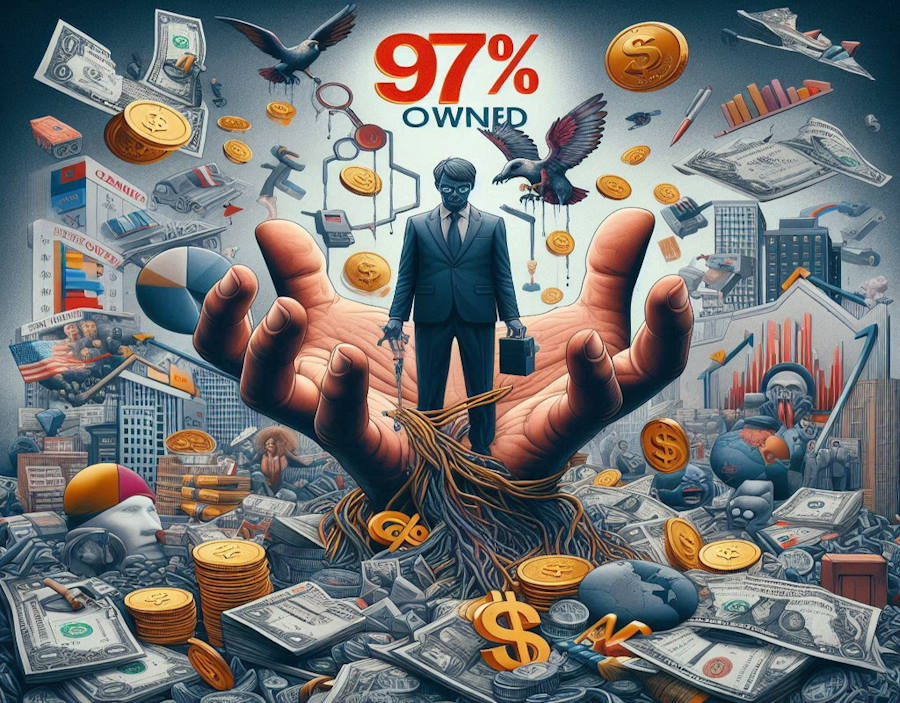

The Hidden Mechanics of Money Creation:

In an era where digital currencies, economic instability, and financial inequality dominate headlines, understanding the underpinnings of our financial system is more crucial than ever. The Film titled "97% Owned: The Cruel Truth Behind Money, Credit, and Financial Crisis" provides a critical exploration of the monetary system, revealing how money is created, who benefits from this process, and how it contributes to recurring financial crises. This blog post aims to expand on these themes, bringing the discussion up to date with the realities of 2024.

The Evolution of Money Creation:

Money, as we know it today, has undergone a profound transformation. Originally, money was tangible—gold, silver, and other physical commodities were used as a medium of exchange. However, with the advent of central banking and modern financial institutions, money became increasingly abstract. Today, the vast majority of money 97% exists not as physical currency but as digital entries in bank accounts.

As of 2024, the global money supply continues to be overwhelmingly digital. In the UK, for instance, the total money supply is estimated to be around £3 trillion, yet only a tiny fraction of this exists as physical cash. This digital money, created predominantly by commercial banks through the issuance of loans, forms the backbone of our modern economy.

Commercial Banks: The Gatekeepers of Money Creation:

The role of commercial banks in money creation is perhaps one of the most misunderstood aspects of the financial system. When a bank issues a loan, it does not simply transfer existing money from one account to another. Instead, it creates new money—a process known as fractional-reserve banking. This money is credited to the borrower's account as a deposit, which they can then spend. As loans are repaid, the created money is effectively destroyed, but the interest paid remains as profit for the bank.

Understanding Fractional-Reserve Banking:

To fully grasp how new money is created, it's essential to understand the concept of fractional-reserve banking. This system allows banks to keep only a fraction of their customers' deposits in reserve and lend out the rest. For instance, if a bank has a reserve requirement of 10%, it needs to keep only 10% of its total deposits on hand and can lend out the remaining 90%.

Here's how the process typically works:

- Deposit and Reserve Creation: When a customer deposits £1,000 into their bank account, the bank is required to keep a portion (e.g., £100, assuming a 10% reserve requirement) in reserve. The remaining £900 is available for lending.

- Loan Creation: The bank can then lend out £900 to another customer. This loan is credited to the borrower's account, effectively creating £900 of new money that did not exist before.

- Money Multiplication: The borrower might spend this £900, which then gets deposited into another bank. The second bank can now keep £90 in reserve (10%) and lend out £810, creating even more new money. This process continues, with each cycle creating additional money until the initial deposit of £1,000 has multiplied into a much larger amount of money circulating in the economy.

This cycle demonstrates how a relatively small initial deposit can lead to a much larger increase in the overall money supply through the lending activities of multiple banks. In essence, banks are not just intermediaries transferring money from savers to borrowers; they are creators of money.

The Implications of Fractional-Reserve Banking:

While fractional-reserve banking has been instrumental in facilitating economic growth, it also introduces significant risks. Because banks lend out more money than they actually hold in reserves, they are vulnerable to "bank runs"—situations where too many depositors demand their money back simultaneously, and the bank cannot meet these demands. To mitigate this risk, central banks often act as lenders of last resort, providing emergency liquidity to banks in distress.

Another consequence of fractional-reserve banking is the amplification of economic cycles. During periods of economic optimism, banks are more willing to lend, creating new money and fueling asset bubbles. Conversely, during economic downturns, banks tighten lending, which contracts the money supply and exacerbates recessions. This boom-and-bust cycle is a direct outcome of the way money is created in a fractional-reserve system.

The Debt-Driven Economy: A Double-Edged Sword:

The Film highlights a critical paradox in the modern economy: money and debt are two sides of the same coin. For money to circulate, someone must be in debt. This relationship creates a systemic dependency on continuous borrowing to sustain economic growth. While debt can fuel investment and consumption, it also creates vulnerabilities.

As of 2024, global debt levels have reached unprecedented heights. According to the Institute of International Finance, global debt exceeded $300 trillion by the end of 2023. This debt burden is not just a concern for governments; households and corporations are also heavily indebted. The reliance on debt to sustain the economy means that any significant disruption—such as a financial crisis, a pandemic, or geopolitical instability—can trigger a downward spiral of defaults, leading to economic contraction and financial turmoil.

The COVID-19 pandemic of 2020-2021 provided a stark reminder of this vulnerability. Governments around the world responded to the economic shock with massive borrowing, pushing global debt to record levels. While these measures were necessary to prevent a deeper recession, they also highlighted the fragility of a debt-dependent system.

Boom and Bust: The Perpetual Cycle of Financial Instability:

The boom-and-bust cycle is an inherent feature of the current monetary system. During periods of economic optimism, banks are more willing to lend, creating new money and fuelling economic expansion. However, this expansion often leads to asset bubbles, such as the housing bubble that precipitated the 2008 financial crisis. When these bubbles burst, the resulting contraction in the money supply triggers recessions, leading to widespread economic hardship.

In 2024, the global economy continues to grapple with the aftershocks of the COVID-19 pandemic and subsequent monetary interventions. Central banks have kept interest rates at historically low levels, encouraging borrowing and investment. However, this has also led to new bubbles in asset markets, including real estate and stocks. The fear of a new financial crisis looms large as central banks face the difficult task of unwinding their monetary stimulus without triggering another downturn.

The Rise of Digital Currencies and Decentralized Finance:

One of the most significant developments in recent years has been the rise of digital currencies and decentralized finance (DeFi). Cryptocurrencies like Bitcoin and Ethereum, as well as central bank digital currencies (CBDCs), have introduced new paradigms in money creation and financial transactions.

By 2024, several countries, including China and the Bahamas, have already launched their own CBDCs, and others are in various stages of development. These digital currencies are seen as a way to modernize the monetary system, improve financial inclusion, and reduce the risks associated with traditional banking. However, they also raise new questions about privacy, surveillance, and the centralization of financial power.

Decentralized finance, which operates independently of traditional banks, offers an alternative to the conventional financial system. DeFi platforms enable peer-to-peer transactions, lending, and borrowing without the need for intermediaries. While still in its early stages, DeFi has the potential to disrupt the traditional banking system by democratizing access to financial services.

However, the rise of digital currencies and DeFi also presents new challenges. The volatility of cryptocurrencies, regulatory uncertainty, and the potential for cyber-attacks are significant concerns that need to be addressed. Moreover, the integration of these new technologies into the existing financial system will require careful consideration to avoid exacerbating financial instability.

Calls for Reform: Rethinking Money Creation:

Given the systemic risks posed by the current monetary system, there have been growing calls for reform. The Film suggests that one potential solution is to separate money creation from banking altogether. This could involve shifting the power to create money from commercial banks to central banks or even introducing a sovereign money system where the state issues money directly.

Proponents of such reforms argue that it would reduce the risk of financial crises by eliminating the reliance on debt to create money. It would also allow for more direct control over the money supply, enabling governments to better manage inflation and economic stability. However, these proposals also face significant opposition from the financial sector and would require a fundamental rethinking of economic policy.

As of 2024, these ideas remain largely theoretical, but they are gaining traction in academic and policy circles. The ongoing debate over the future of money highlights the need for a more resilient and equitable financial system.

Conclusion: Navigating the Future of Money:

The Film "97% Owned: The Cruel Truth Behind Money, Credit, and Financial Crisis" provides a sobering analysis of the flaws in the current monetary system. As we move further into the 21st century, the challenges posed by money creation, debt dependency, and financial instability are more pressing than ever.

In 2024, the global financial system stands at a crossroads. The rise of digital currencies, the ongoing risks of financial crises, and the growing calls for reform all point to the need for a new approach to money and banking. Whether through gradual reforms or more radical changes, the future of our economy will depend on our ability to create a financial system that is stable, inclusive, and sustainable.

Without significant changes, the boom-and-bust cycles of the past will likely continue, with potentially devastating consequences for societies around the world. It is up to policymakers, economists, and the public to engage in this crucial debate and to chart a course toward a more secure financial future.