You can reduce your costs of production and improve your profitability. By using what you have to pay for what you need

GETS Trade harnesses practical expertise to transform surplus capacity into revenue, monetizing untapped resources to preserve cash, boost sales, increase efficiency, reduce waste, and enable businesses to create and issue Premium Points.

How GETS Trade Improves your Cash Flow

There are two main ways to increase cash flow - more sales and reduced cash outlay.

GETS Trade Does Both.

GETS Trade allows you to pay with what you have for what you need - thus allowing you to preserve working capital for other needs.

When you use Trade Credits instead of cash to purchase needed goods and services - you reduce your cash outlay by paying for them with new revenue generated from marginal sales... sales that probably would not have happened without Trade.

GETS Trading Means Wholesale Buying Power

With GETS Trading, the real cost of the goods or services you purchase is actually the wholesale cost of your goods sold which naturally gives you a discount.

Making sales with built-in profits makes the cost of your purchases more economical.

When you join GETS Trading, you open the door to a new, cash saving means of handling everyday business and personal expenses.

Trade Credits are earned from Unsold Capacity & Products and are a marginal costs to every business

Cash & Trade Credits Blends

GETS Trading allows Members with positive trade balances to accept a blend of Cash (£GBP) and Trade Credits, our members are less likely to become overloaded with Trade Credits at the cost of their cash flow.

Zero-Cost Trade Credits: Maximizing Cash Flow and Profits!

GETS Trading recommends that Members take cash for the raw cost, which is the cash they would pay out to replace the stock sold or purchased, and then take trade credits for the balance, which is the marginal cost of sale, keeping prices the same as for cash only transactions.

Unlocking Extra Business with Zero Additional Costs!

Because cash has been paid for the raw cost of this new business, there is no actual cost to do the extra business that would come through GETS Trading membership. This extra business is over and above existing sales volume (turnover), and is business that would not otherwise have been generated if they had not joined the Exchange. All fixed costs and overheads are covered by existing turnover.

Zero-Cost Trade Credits: The Perfect Business Boosting Trading Alternative!

So, this produces the perfect trading alternative whereby businesses not only conserve cash from existing customers, but also increase their cash flow through new business, and they have generated trade income from the profit on business they would otherwise never have had, the actual cost of Trade Credits to them is ZERO.

The Exceptions!

There are exceptions on the blend of Cash & Trade rule this is where members who have a Trade Credit Line and a negative balance are required to repay on 100% Trade whether they are selling Hard or Soft Goods.

Fair Trading Policy

ALL Marketplace Items that have a dual currency price Cash/Trade Credit blend MUST be the same as your normal published or listed CASH Price.

Building Sustainable Business Relationships through GETS Trading!

It should be noted that in order to build repeat business and ongoing relationships within GETS Trading, there has to be a mutual fairness between clients. Categorising Soft Goods as 100% and Hard Goods as part cash part Trade Credits is a good rule to follow. It's all about negotiation and the actual nature of the goods traded.

Simple Example

If a hotelier wanted to sell a room night (soft good) priced at $100.00 on 50% cash and 50% Trade Credits that would NOT be acceptable. However, if the hotelier wanted to sell a conference priced at £100,000.00 on 30% cash and 70% Trade Credits this would be acceptable as there would be cash costs involved.

Like what you see? Become a member and start trading your capacity today!

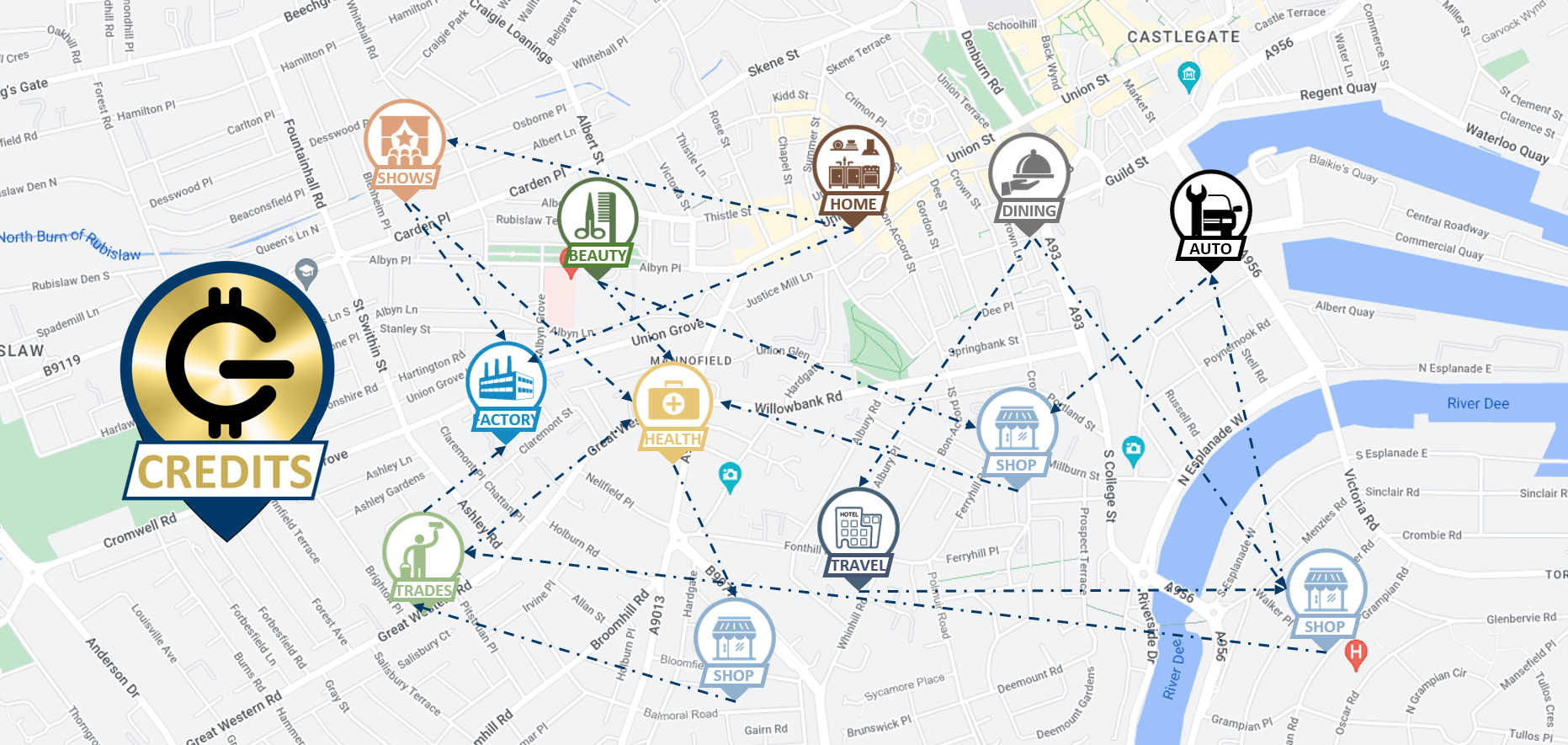

See membershipsA B2B (business-to-business) trade exchange is a platform or marketplace that enables a network of businesses to buy and sell goods or services with other businesses.

In a B2B trade exchange, businesses can create profiles, list their products or services, and find potential buyers or suppliers within the network. This can help businesses increase their market reach, reduce transaction costs, and find new business opportunities.

In a B2B trade exchange where the medium of exchange is a trade credit , businesses can use these credits to buy goods or services from other businesses within the exchange. Essentially, a trade credit is a form of currency that is only accepted within the trade exchange and is used as a means of payment for transactions between businesses.

Here's an example of how a trade credit system could work:

1) Business A joins the trade exchange and receives a credit line of, say, £10,000.

2) Business B also joins the exchange and lists products for sale, with a total value of £2,000.

3) Business A purchases the products from Business B using their trade credit account.

4) Business A now owes the trade exchange £2,000 in trade credits, which they can pay back in the future by selling their own products or services to other businesses within the exchange.

5) Business B receives the trade credits from Business A and can then use them to purchase products or services from other businesses within the exchange.

By using trade credits as a medium of exchange, businesses within the trade exchange can buy and sell products without having to use money. This can help to reduce transaction costs and increase liquidity within the exchange, as businesses can trade with one another more easily and quickly.