BUILDING ECONOMIC RESILIENCE IN A CHANGING MARKET

In today’s economic landscape, businesses face fluctuating demand, rising costs, and a tighter credit environment. Small and medium-sized businesses (SMEs) are particularly vulnerable as they often have limited cash reserves, leaving them exposed to even minor financial disruptions. GETS Trade offers an innovative, alternative financing model that can support SMEs during these challenges.

Economic Challenges: Post-pandemic economic shifts, inflationary pressures, and increased borrowing costs have made traditional financing options less viable for many businesses.

SMEs and Cash Flow Vulnerability: Cash flow constraints impact the day-to-day operations of SMEs, from making payroll to maintaining inventory, and can hamper growth.

Alternative Solutions Are Needed: Traditional financing options—such as loans or credit lines—often come with high interest rates and strict repayment terms, which may not be feasible for SMEs. GETS Trade provides an alternative, interest-free means to enhance cash flow without increasing debt.

DEAD CAPITAL

Unlocking the Potential of “Dead Capital”

“Dead Capital” refers to assets that remain unproductive, underutilized or unsold draining resources rather than generating income. Globally, Dead Capital is estimated to be worth between $13-20 trillion.

In the UK, Dead Capital is estimated to be worth £667 billion, with £62.5 billion attributed to Scotland alone. These figures highlight the significant economic potential within unsold or underutilized assets.

For the 5.6 million businesses across the UK, these dead capital assets represent an untapped potential for revenue and growth, with an estimated average shortfall of -£120,892.

Types of Dead Capital: Dead Capital can be unsold inventory, unused appointments, empty hotel rooms, vacant office spaces, or any other asset not actively generating revenue.

The Economic Burden of Idle Assets: Fixed costs such as rent, utilities, and salaries remain constant whether assets are utilized or idle, putting financial pressure on businesses.

Opportunity for Revenue Recovery: By tapping into GETS Trade, businesses can monetize these dormant assets by exchanging them for Trade Credits, which can then be spent on goods and services they need, effectively turning unused capacity into tangible value.

THE GETS TRADE SOLUTION:

Transforming Unsold Capacity into Business Value:

GETS Trade introduces a way to repurpose unsold assets and boost cash flow through a B2B Capacity Trade Exchange. Businesses can offset expenses and reinvest trade credits into operational needs, helping maintain cash reserves for essential spending.

Trading Unsold Assets for Essential Services: Instead of allowing assets to remain idle, businesses can exchange them within the GETS Trade network for other necessary goods or services.

Reducing Cash Dependency: By covering expenses with trade credits, businesses can allocate cash for other strategic purposes, like expansion or investment.

Access to New Clients: GETS Trade connects businesses within a closed-loop marketplace, providing exposure to potential customers who may have similar cash flow goals.

TRADE CREDITS:

A Complementary Digital Currency for the Business Community:

GETS Trade operates on a unique digital currency known as Trade Credits, functioning as a parallel currency within the network. This approach facilitates transactions without cash and creates a cooperative economic model.

How Trade Credits Work: Businesses within the GETS network agree to accept Trade Credits as a form of payment, offering flexibility in exchanging goods and services without relying on cash transactions.

Strengthening Business Relationships: By engaging in trade using credits, businesses build a support network, encouraging ongoing exchanges and mutual economic support.

Peer-to-Peer Mutual Credit Clearing: The system operates as a mutual credit clearinghouse, creating a self-sustaining marketplace where trade credits maintain value due to mutual backing by member enterprises.

ECONOMIC BENEFITS OF GETS TRADE

Interest-Free Credit, Increased Sales, and More:

The GETS Trade system offers a range of economic benefits, helping businesses achieve greater financial stability and flexibility. These advantages empower companies to operate more strategically and resiliently.

Interest-Free Credit Lines: With access to interest-free credit, businesses can reduce dependence on traditional loans, eliminating interest payments that would otherwise strain cash flow.

Offset Operational Costs: Trade Credits allow businesses to cover regular expenses—such as advertising, office supplies, or utilities—without using cash, effectively providing a cash-flow buffer.

Debt Recovery Mechanism: Businesses with overdue invoices or potential bad debt can trade within the network to recover value, effectively recapturing lost revenue without direct cash outlay.

Competitive Edge and Customer Attraction: Offering Trade Credits as a payment option provides an alternative that may attract customers, particularly those within the network, fostering loyalty and retention.

PRACTICAL APPLICATIONS OF GETS TRADE IN DIFFERENT SECTORS

GETS Trade’s ability to convert unsold assets into valuable resources makes it ideal for businesses across diverse industries, from hospitality to professional services. Here’s how it applies in various contexts:

Hotels and Hospitality: Empty hotel rooms during off-peak seasons represent lost revenue. Hotels can trade room stays for maintenance services or marketing efforts, keeping operations funded without additional cash.

Restaurants and Retail: Restaurants with low mid-week traffic can trade empty seats for supplies or staff training, while retailers can trade excess inventory for advertising credits, maximizing value from unsold stock.

Service Industries: For professional services such as consulting, law, or accounting, any unfilled appointment slots can be traded for other business essentials, minimizing idle time and improving resource use.

STRENGTHENING LOCAL ECONOMIES THROUGH COMMUNITY-FOCUSED TRADE

GETS Trade empowers businesses to support each other by keeping trade within local economies, creating a stronger business ecosystem and fostering community collaboration.

Reinforcing Local Economies: By facilitating trades within the network, GETS Trade ensures that business resources circulate locally, promoting economic resilience.

Community Collaboration: Businesses build mutually beneficial relationships, supporting each other in times of financial strain and fostering a sense of community.

Driving Local Foot Traffic: With customer loyalty initiatives, GETS Trade encourages consumers to choose local businesses over large corporations, creating a local-first mentality.

SECURE, SIMPLE, AND TRANSPARENT:

A User-Friendly System for Busy Business Owners:

The GETS Trade system is designed to be straightforward, allowing businesses to manage transactions easily. This ease of use, combined with robust security, ensures a reliable trading experience.

Accessible Platform: The platform provides a user-friendly interface, making it accessible to business owners with varying levels of tech-savvy.

Data Security and Transparency: Transactions on GETS Trade are secure and auditable, protecting both trade credits and sensitive data.

Enhanced Financial Oversight: The system offers data and reporting tools to track credits, providing clear insights for better financial planning.

CUSTOMER LOYALTY AND RETENTION:

Building Lasting Relationships Through GETS Trade:

In addition to helping businesses manage cash flow, GETS Trade provides tools to enhance customer loyalty, helping businesses retain and engage clients in unique ways.

Creating Unique Value for Customers: Trade Credits provide customers with flexible payment options, encouraging repeat business and improving loyalty.

Engaging New Clients: By attracting clients who appreciate alternative payment options, businesses can create a unique selling point that sets them apart from competitors.

Increasing Retention: Customers who see value in trade credits are more likely to stay loyal, promoting retention and long-term engagement within the network.

GETS TRADE AS A CATALYST FOR SUSTAINABLE GROWTH

GETS Trade offers a strategic alternative to traditional finance models, providing resilience, stability, and a growth pathway that doesn’t rely on debt. By leveraging trade credits, businesses can create a sustainable economic foundation.

Diversified Revenue Streams: Converting idle assets into tradeable resources diversifies income, stabilizing revenue flows and supporting financial resilience.

Investment Without Cash Strain: Businesses can reinvest trade credits into assets or services that promote growth without impacting cash reserves, balancing immediate needs with long-term goals.

Economic Independence: GETS Trade reduces reliance on external funding sources, giving businesses greater control over their financial stability and empowering them to make growth decisions without external pressures.

WHY GETS TRADE IS ESSENTIAL FOR THE LOCAL BUSINESS LANDSCAPE

GETS Trade presents a powerful alternative for businesses looking to optimize cash flow, reduce idle assets, and build financial resilience. With a supportive network and a simple, transparent trading system, it provides a toolkit for businesses seeking to navigate today’s economic challenges sustainably.

Key Benefits Recap:

Interest-Free Financing: Secure necessary goods and services without traditional interest costs.

Customer Retention and Loyalty: Provide flexible payment options that resonate with customers.

Revenue from Unsold Assets: Convert unproductive assets into tradeable resources, generating value.

Local Economic Strengthening: Build collaborative, locally-focused economic networks.

Ease of Use and Transparency: Access an intuitive, secure platform for streamlined transactions.

By adopting GETS Trade, business owners can harness a new approach to financial management, supporting growth while strengthening the business community around them. This innovative system represents a future-forward model for cash flow management, creating sustainable, interconnected economic ecosystems.

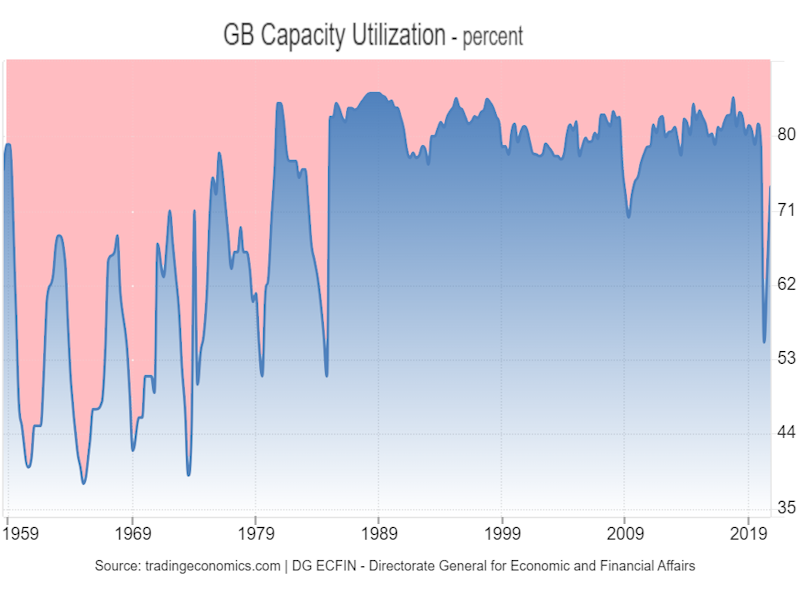

UNITED KINGDOM CAPACITY UTILIZATION

https://tradingeconomics.com/united-kingdom/capacity-utilization

UK capacity utilization rose to 73.9% in Q4 2023 from 64.5% in Q3, indicating recovery post-COVID. Historically, it averages 72.83% (1958–2020), peaking at 85.2% in 1988 during strong economic growth, and hitting a low of 38.0% in 1965 amid industrial challenges. This measure highlights shifts in demand, production, and economic health.

To estimate the annual value of unutilized capacity for the UK in 2024, we can apply the unused capacity percentage to the annual GDP for that year.

- UK GDP for 2023: Approximately £2.2 trillion.

- Estimated Capacity Utilization for 2023: 73.9%, approximately averaging to 69.2%.

- Average Unutilized Capacity up to 2023: 30.8% of capacity remained unutilized on average.

- UK Unrealised income up to 2023 up to 2023: = £2.2 trillion × 0.308 = -£677 billion

Thus, the estimated value of unutilized production capacity for the UK in 2023 was around £677 billion.

SCOTLAND’S CAPACITY UTILIZATION

For Scotland, we can estimate unutilized capacity based on similar principles, using Scotland's GDP and an approximation of its capacity utilization rates in 2020. Assuming Scotland’s capacity utilization was similar to the UK's average of 69.2%, around 30.8% of productive capacity would remain unused.

- Scotland's GDP for 2023: Approximately £212 billion.

- Estimated Capacity Utilization for 2023: 73.9%, approximately averaging to 69.2%.

- Average Unutilized Capacity up to 2023: 30.8% of capacity remained unutilized on average.

- Scotland's Unrealised income up to 2023: = £212 Billion × 0.308 = -£65.2 billion

As at March 2022, there were an estimated 360,910 private sector businesses operating in Scotland. The vast majority of these businesses (98.3%) were small (0 to 49 employees). A further 3,835 businesses (1.1%) were medium-sized (50 to 249 employees) and 2,340 businesses (0.6%) were large (250 or more employees).

- Total Unutilized Capacity for Scotland (2020): Estimated at £51.7 billion.

- Total Private Sector Businesses (2022): 360,910.

- Estimated Unrealized Income per Scottish Business: -£143,246

Data Sources:

https://tradingeconomics.com/united-kingdom/capacity-utilization

https://www.gov.scot/publications/businesses-in-scotland-2022/pages/business-size/

UNITED KINGDOM STATISTICS

The services sector accounts for the majority of the United Kingdom's GDP, contributing 81% of the country's economic output in April–June 2024. The service sector includes industries such as retail, finance, public sector, business administration, and leisure and cultural activities.

As of the start of 2023, there were an estimated 5.6 million private sector businesses in the United Kingdom:

- Small businesses: 5.51 million businesses with 0–49 employees

- Medium-sized businesses: 36,900 businesses with 50–249 employees

- Large businesses: 8,000 businesses with 250 or more employees

The UK's business population has increased by 60% since 2000, but has decreased by 7.1% since 2020. The growth in the business population has slowed since 2018.

The UK's private sector businesses are made up of:

- Sole proprietorships: 3.1 million businesses, or 56% of the total

- Actively trading companies: 2.1 million businesses, or 37% of the total

- Ordinary partnerships: 365,000 businesses, or 7% of the total

In 2023, SMEs employed 16.7 million people in the UK, which is 61% of the total number of people employed by private sector companies

Here's a breakdown of the UK's GDP by industry in April–June 2023:

- Services: 81% of GDP

- Manufacturing: 9.1% of GDP

- Real estate: 13.1% of GVA, but most of this is the value of "imputed rents"

- Retail and wholesale: 9.9% of GVA

- Agriculture: 0.76% of GDP

Small businesses are also a critical part of the UK economy, making up around 99.9% of all businesses. They contribute to the economy at both the national and local levels.