The Illusion of Prosperity in the UK:

How the FTSE Fails to Reflect the Realities of the UK Economy:

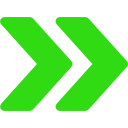

When news outlets report a strong FTSE 100, they often imply that this growth is a sign of economic prosperity shared by all Britons. The reality, however, is starkly different. The FTSE’s performance is largely driven by the profitability of around 2,000 publicly listed companies, which represent less than 0.04% of the UK’s 5.6 million businesses. While these companies contribute significantly to the UK’s GDP and employ a substantial portion of the workforce, the success they enjoy rarely extends to the rest of the economy.

For the average small business owner, family, or local worker, the prosperity reported by the FTSE feels like a distant phenomenon. Since 1973, real wages in the UK have stagnated, barely keeping up with inflation. While FTSE-listed corporations have thrived—distributing dividends, growing market shares, and capturing global profits—ordinary people have seen little to no improvement in their financial situations. This disconnection between the health of the FTSE and the well-being of the population is an issue that needs more public scrutiny.

The Rise of Corporate Dominance and the Decline of Small Businesses:

Over the last four decades, large corporations have steadily increased their control over the UK market. Once-thriving small businesses, the lifeblood of local economies, have struggled to compete with corporate giants that can use their scale to undercut prices, reduce competition, and dominate market share. While big businesses enjoy significant advantages in terms of capital, resources, and political influence, small businesses are often left grappling with regulatory barriers and financial constraints.

This corporate dominance has profound effects:

Unfair Competitive Landscape: Large corporations have the resources to navigate complex regulations and compliance costs, whereas small businesses are often overwhelmed by these same requirements. This regulatory burden creates an uneven playing field, favoring those who already hold power and wealth.

Diminished Market Diversity: With big companies swallowing up smaller competitors or driving them out, consumers are left with fewer choices, and local communities lose the unique, personalized service that small businesses provide. This trend is particularly damaging in rural or economically disadvantaged areas where SMEs play a crucial role in providing jobs and services.

Influence Over Government Policy: The sway that large corporations hold over policymakers means that government regulations often cater to big businesses’ needs. Corporate lobbying shapes policies in ways that small businesses cannot afford to counter, reinforcing the dominance of these corporations and often sidelining smaller enterprises.

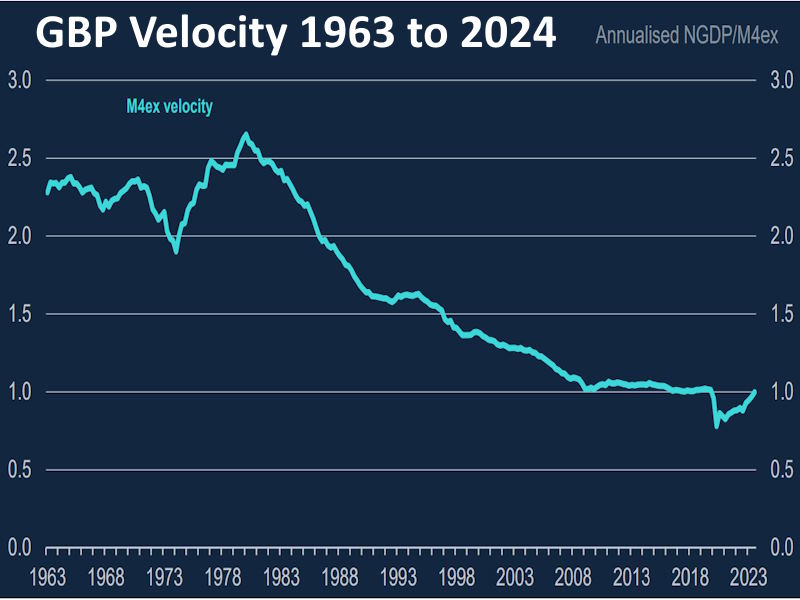

A Startling Trend: The Decline of the Pound’s Velocity:

Since 1980, the velocity of the UK pound has dropped drastically—from a high ratio of 2.65 to just 0.90 in 2022. The “velocity of money” measures how quickly money moves through the economy, reflecting how often each pound is spent in a given period. A higher velocity indicates a dynamic, circulating economy where money frequently changes hands, boosting GDP and spreading wealth throughout society. In 1980, each pound generated around £2.65 in economic activity, creating a ripple effect of spending and job creation across sectors. In 2022, however, this impact has dwindled, with each pound now producing only £0.90 in economic activity.

To put this in perspective, while the velocity of the US dollar stands at 1.181, the UK pound has become considerably less effective in driving economic growth. Today, every pound has to work almost three times as hard to maintain the same level of GDP as in 1980. This decline in velocity suggests a slowing economy where wealth is not circulating as freely or inclusively as it once did.

https://www.whatdotheyknow.com/request/uk_money_velocity/response/2532723/attach/3/Information.pdf

The Connection Between Corporate Dominance and Reduced Money Velocity!

This dramatic decline in the pound’s velocity is closely tied to the rise of corporate dominance and the shrinking role of small businesses:

Wealth Concentration: Large corporations amass wealth and often retain it within their financial structures, distributing profits to shareholders rather than reinvesting in local economies. When wealth becomes concentrated in the hands of a few, it stops circulating broadly across the economy, slowing the money flow and reducing the overall economic multiplier effect.

Reduced Consumer Spending at Local Levels: Small businesses, which are more likely to reinvest profits locally, are sidelined by big companies that prioritize shareholder profits. The closure or downsizing of local shops, family businesses, and independent contractors leads to lower levels of consumer spending in communities, creating a cycle that further slows money movement across the economy.

Market Power and Price Control: Large corporations often use their market power to set prices and wages, impacting inflation and consumer purchasing power. This influence over prices, especially in essential sectors like energy, housing, and retail, means that consumer costs rise even when wages do not, squeezing disposable income and reducing people’s ability to contribute to economic growth through spending.

How This Affects Everyday Britons:

The Cost of Living and Economic Mobility:

The dominance of large corporations and the decreased circulation of money have tangible effects on daily life in the UK. Rising living costs, stagnant wages, and fewer job opportunities in small businesses leave many people struggling to make ends meet. This environment has particularly dire consequences for economic mobility:

Cost of Living Crisis: With large companies able to influence prices, essential goods and services have become more expensive. Households face higher bills for energy, food, and housing, exacerbating the cost-of-living crisis. Meanwhile, corporate profits remain largely unaffected by these price hikes, with gains accruing to executives and shareholders rather than employees or local communities.

Job Insecurity and Wage Stagnation: As large corporations dominate the job market, they increasingly rely on outsourcing, short-term contracts, and gig economy roles that offer few benefits and little job security. While corporate profits have soared, wages have barely budged, leaving workers with diminished financial security and limited career growth.

Erosion of Community Wealth: When local businesses close, communities lose more than just jobs—they lose social and economic cohesion. Small businesses often invest in their neighborhoods, sponsor local events, and provide personal customer service that strengthens community ties. Corporate giants, in contrast, are typically detached from the localities they operate in, contributing little to the local economy beyond low-wage jobs.

Revitalizing the Economy Through Small Business Support:

To reverse these trends, the UK must create an economic environment where small businesses can thrive and money can circulate more effectively. Here’s what can be done:

Tax and Incentive Reforms: Tax breaks or incentives for consumers who shop locally and for SMEs that reinvest in their communities can help stimulate local economies. These measures would increase the flow of money in smaller, more impactful ways.

Reducing Regulatory Burdens for SMEs: Simplifying compliance requirements and reducing the tax burden on small businesses would help level the playing field, allowing them to compete and contribute to economic growth.

Encouraging Corporate Social Responsibility: Large corporations could be incentivized to invest more heavily in the communities where they operate, including through fair wages, local hiring, and sustainable practices. By prioritizing community engagement over shareholder dividends, corporations could help reinvigorate the UK economy from the ground up.

Increased Funding and Grants for SMEs: The government could provide targeted funding and grants to support SMEs, fostering growth and encouraging the development of new, innovative businesses that contribute to local and national prosperity.

Conclusion: Building an Economy for Everyone, Not Just the FTSE:

The narrative that a strong FTSE indicates a thriving UK economy is misleading for most Britons. The decline in the velocity of money and the concentration of wealth within a small percentage of corporate entities highlight the need for fundamental changes. For Getslocal members, local business owners, and everyday citizens, a thriving economy means more than rising stock prices; it means wages that keep pace with inflation, affordable goods, and an environment where small businesses can flourish.

By promoting policies that prioritize SMEs, fair wages, and the equitable circulation of wealth, the UK can work toward an economy that benefits everyone, not just corporate shareholders. For a genuinely prosperous future, the economy must move beyond the narrow successes of the FTSE and work to revitalize the role of small businesses, increasing money velocity and fostering a more inclusive and resilient economic landscape.