Unveiling the Untold Story of Money's Velocity

Velocity of Money: The Overlooked Economic Indicator:

In the world of economic discourse, certain terms tend to dominate the conversation—GDP, inflation, and interest rates. However, there's one crucial concept that has slipped under the radar, despite its profound implications: the Velocity of Money. It's a phrase that isn't being used by mainstream media commentators, or their economist peers, but it should be at the forefront of every economic discussion.

Today, we're going to unpack why the velocity of money matters, particularly in the context of the UK's economy.

See BOE Velocity Table: The UK Money Velocity Response

The Decline of the Pound’s Velocity

A Startling Trend:

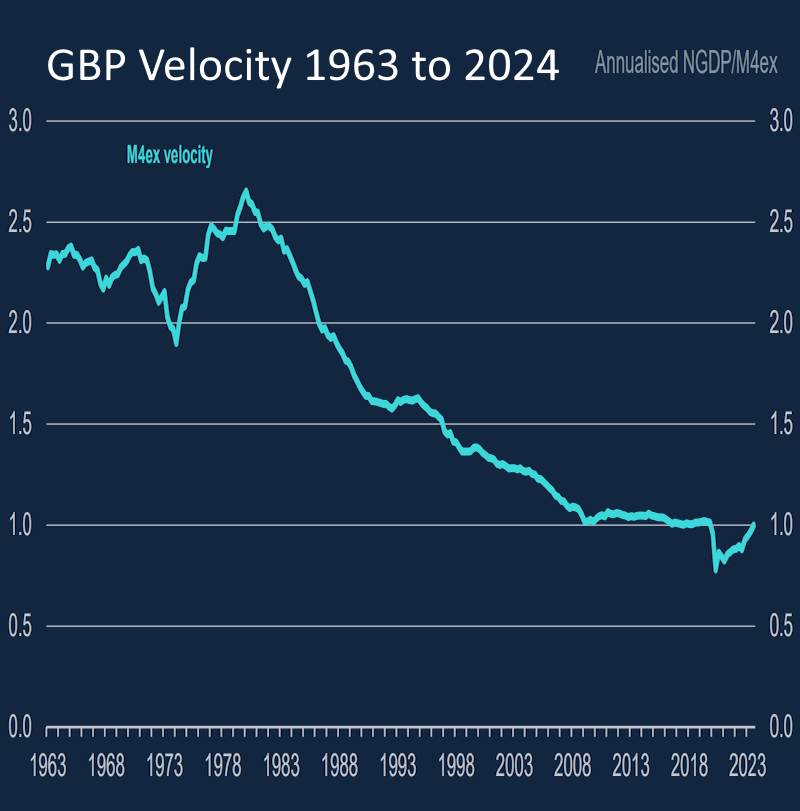

Let’s begin with a sobering statistic: since 1980, the velocity of the UK pound has dropped dramatically, from a robust ratio high of 2.65 to a concerning low of 0.90 in 2022. For those unfamiliar with the term, the velocity of money measures how quickly money circulates through the economy. A ratio of 2.65 meant that each pound was used more than twice and a half in transactions over a given period, effectively multiplying its impact on the economy. Today, that impact has diminished sharply. To put it in perspective, while the US dollar’s velocity stands at 1.181, the UK pound has become significantly less effective in stimulating economic activity since the turn of the century.

This decline in velocity means that the pound issued today has to work almost three times as hard just to maintain the same level of GDP economic activity as each pound issued in 1980. In 1980, every pound created by the banks would generate £2.65 in GDP. Today, that same pound generates only £0.90. The decreased velocity indicates that money is changing hands less frequently, which stifles economic growth. The pound has become less dynamic, less effective, and far less powerful as a tool for driving the economy forward.

A Surplus of Money: Record Highs in Circulation:

You might think that more money in circulation would naturally lead to a thriving economy. Interestingly, the UK has never had more money floating around than it does today, with approximately £3,031,444 billion in circulation—a record high. But before we start celebrating, it's crucial to understand where this money comes from. A staggering 97% of this money is created through debt—loans issued by banks. This means that the more debt is accumulated, the more money is theoretically available for spending and investment. However, this influx of money hasn't translated into the economic growth one might expect.

The Real Problem: Money That Isn’t Moving:

Here's the heart of the issue: while there's more money than ever before, it's not moving through the economy as it should. In 1980, every pound created by the banks would generate £2.65 in GDP. Today, that same pound generates only £0.90. This decline in the velocity of money indicates that money is changing hands less frequently, which stifles economic growth. In simple terms, we don't need more money; we need the money to change hand more frequently and we have to be more active in the local economy.

The Concentration of Wealth: A Growing Concern:

Why isn't money moving as it should? The answer lies in the growing concentration of wealth. Increasingly, pounds are being hoarded by a small segment of the population, while the rest struggle to keep money circulating. This trend is dangerous because it leads to economic stagnation. When money is concentrated in too few hands and remains stationary, it loses its ability to drive economic activity, creating a feedback loop of slower growth and lower economic vitality.

A Call to Action

Reviving the Velocity of Money:

So, what can be done to reverse this troubling trend? The solution isn’t simply to create more money—it’s to get the existing money moving. We need policies and practices that encourage the circulation of money throughout the economy, ensuring it reaches more hands and generates more economic activity. This could involve measures like progressive taxation, investment in public services, and incentives for businesses to increase wages and hire more workers.

We must also acknowledge an inevitable reality:

No matter what we do, a significant portion of local pounds will eventually leave our local economy. However, there’s a powerful opportunity here. If we can ensure that each pound passes through just one more set of hands before it exits, we can double the velocity rate and boost local GDP in one fell swoop. This single additional transaction for each pound can have a compounding effect, driving economic growth and fostering a more resilient local economy. The focus, therefore, should be on maximizing the impact of each pound while it’s still within our borders, making sure it touches as many lives and businesses as possible before it departs.

Conclusion: Shifting the Economic Paradigm:

It’s time to change the narrative. Instead of focusing solely on the money supply, we must prioritize the velocity of money—the lifeblood of a dynamic and inclusive economy. The UK pound needs to regain its vitality by moving more freely through all levels of society. Only then can we hope to unlock the full potential of our economy, fostering growth that benefits everyone, not just a privileged few.

Stay tuned as we continue to explore the intricacies of economic concepts like the velocity of money, advocating for a shift in how we think about wealth, growth, and prosperity. Together, we can reignite the spark that drives our economy forward.